[ad_1]

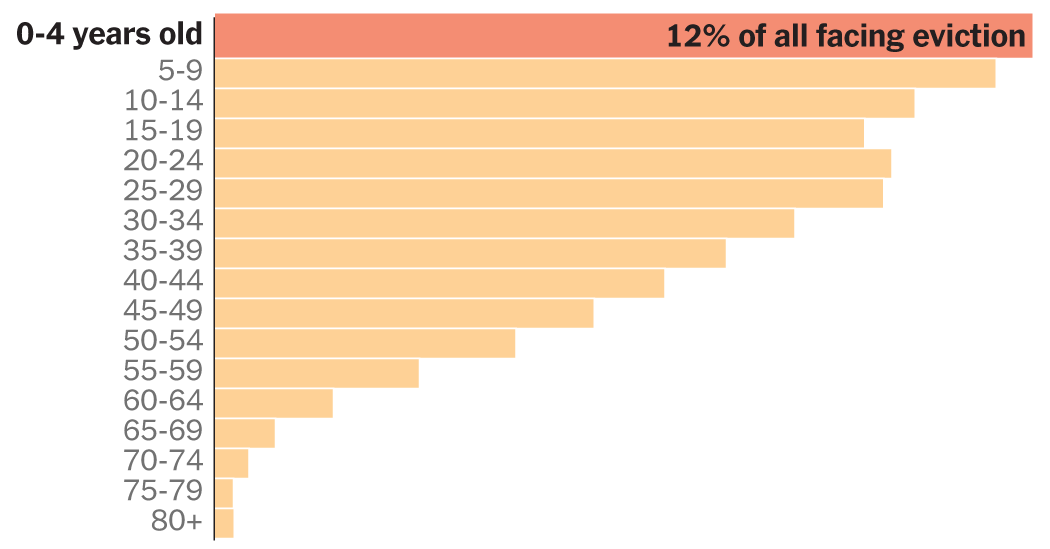

The Americans most at risk of eviction are babies and toddlers, according to new data that provides the fullest demographic picture yet of who lives in rental households facing eviction nationwide.

Children under 5 make up the largest group by age of those whose households have had an eviction filed against them, weathering instability during crucial years for their development.

These children are typically invisible in legal documents that track eviction cases and that name only adults and leaseholders summoned to court. But by linking hundreds of thousands of eviction files to detailed census records, researchers at Princeton, Rutgers and the Census Bureau have identified the other people living in these homes.

All children, and especially the youngest, account for a disproportionate share of those threatened with eviction, the study found. And the risk is acute for Black children and their mothers, ages 20 to 35. In a given year, about a quarter of Black children under 5 in rental homes live in a household facing an eviction file.

Those patterns reflect in part how poorly the American housing market serves low-income families. And it suggests that housing instability falls heaviest on a young population least equipped to handle it.

“When I started writing about these issues, I kind of thought kids would shield families from eviction,” said Matthew Desmond, who leads the Princeton Eviction Lab and contributed to the study, published Monday in the Proceedings of the National Academy of Sciences. “But they expose families to eviction.”

That is true, researchers, tenants and lawyers said, because renters with children face added financial burdens, limited housing options, and often discrimination from landlords.

“It is worse than I thought — it’s worse than I think many people will have expected,” said Shawnita Sealy-Jefferson, a social epidemiologist at Ohio State who has been studying Black mothers and caregivers facing eviction in Detroit. In her surveys and focus groups, women describe landlords who disdain them, and children with depression from unexpected moves. “How do you get over this? One woman said, ‘Your kids never really get over being evicted.’”

For landlords, children often bring unwanted risk. They make noise. They draw on walls. They require lead testing. For parents, having a baby can be a financial shock, making them more likely to miss income. Low-wage workers are also least likely to receive paid parental leave, and more likely to have to take care of a baby.

The Fair Housing Act protects families with children from discriminationbut that doesn’t necessarily stop landlords, said Eva Rosen, an associate professor at Georgetown, who has interviewed of hundreds of landlords. They don’t say they’re evicting a renter because of the children, she said. But when families fall behind on rent, that “leaves renters vulnerable to landlords deciding who they do and don’t want to be lenient with.”

The National Apartment Associationwhich represents landlords big and small, argues that the larger problem is a national shortage of affordable housing and insufficient aid for low-income renters: “The answer is the same for a family or an individual facing eviction,” said Greg Brown, the group’s senior vice president for government affairs.

The new study sheds light on children by matching the names and addresses on eviction filings to responses to the American Community Survey, a census questionnaire given annually to a sample of American households. It also collects data on race that is missing from court documents.

Between 2007 and 2016, the years covered by the data, the researchers estimated that 2.9 million children were affected by an eviction filing each year. Every filing does not lead to an eviction judgment, but the cases leave lasting marks on credit reports that can influence a family’s ability to find stable housing for years. And many families leave their homes without waiting for a court order.

Evictions broadly declined with emergency pandemic-era policies, including eviction moratoriums, emergency rental assistance and an expanded safety net. But with those policies no longer in effect, the researchers believe that evictions are now returning to or surpassing the levels documented in the study, with the same groups disproportionately affected, said Nick Graetz, the lead author of the study.

At every income level, they found, households with children are more likely to receive an eviction judgment than households with no children. And the risk factor of children is especially apparent for Black female renters: 28 percent of those with children are threatened by eviction, compared with 16 percent of those without.

Housing instability makes parents stressed, which can affect children’s well-beingand it can cause children to experience other stressors, like food insecurity and gaps in health coverage.

“Especially with young children, the disruption strains parenting unbelievably, and when parents are strained, so they are children,” said Patrick Fowler of Washington University in St. Louis, who studies homelessness and its effects on children. When families are forced to move often, he said, “kids are just constantly taking a hit on well-being, on cognitive development, on making friends, learning how to be friends, connecting with meaningful adults.”

Starting in kindergarten, public schools provide food, transportation, school nurses and relationships with teachers. And schools are required by federal law to identify and provide resources to homeless children. But low-income children under 5 have little such formal support.

Their families have constrained housing choices, given that the most affordable units — studios, one-bedrooms and single-room occupancy hotels — aren’t large enough to house children comfortably. Doubling up with friends and family is difficult with children in tow. And when a family must move with an eviction filing on its record, that narrows the next housing options even more.

“It’s really a different section of the housing market that people are being pushed into,” said Jennifer Erb-Downward, who analyzes poverty and housing policy at the University of Michigan. This corner of the market typically doesn’t require credit reports. But the living conditions and legal protections are worse, and the rents aren’t that much cheaper. Tenants may have month-to-month leases or informal agreements. Scams are commonplace.

“We’ve trapped families into this,” Ms. Erb-Downward said.

Dionnah Wearing, a 28-year-old single mother, believed she was renting a legitimate three-bedroom row home in Philadelphia when she moved in with her young daughter in 2019. But the property manager became less responsive as problems with the house set up, she said. Mold grew in the enclosed porch, and her daughter and a baby boy born last year developed respiratory problems.

Ms. Wearing eventually learned that the home didn’t have a valid rental license or a lead certificate on file with the city. But even without an eviction on her record, she can’t find another home that’s affordable, big enough for her children and close to school and day care. For now, she and her children stay with friends and relatives, or in hotels.

“My daughter constantly asks me, ‘When are we going to go home?’” said Ms. Wearing, whose daughter is 8. “She asked to play with her toys. She feels sad her friends de ella ca n’t come over to play. She asks, ‘Are we homeless if we have nowhere to go?’”

In court, there’s no special leniency for families, said Holly Beck, a lawyer with Community Legal Services in Philadelphia, who has been assisting Ms. Wearing. Ms. Beck has seen infants in the courtroom, and children whose mothers had to choose between making school drop-off or an 8:45 am court summons.

If policymakers recognized the problem of evictions as one that largely affects children, researchers and activists said, the solutions would go beyond housing.

Families too young to be screened for housing instability at school could receive referrals to services in pediatricians’ offices. Cities could start, as Seattle has, a school-year moratorium on evictions for households with minors. some states and cities seal eviction records, reducing the risk that families are pushed toward predatory landlords. Research has also linked expansions of the earned-income tax credit to better housing outcomes for low-income mothers and children.

Children are resilient, Professor Fowler said, and stability later in childhood can erase some of the harmful effects of instability earlier. Inside homes, family routines and parental warmth are protective for children, as is improved maternal mental health.

“We all want to feel that when we go home, we feel safe, we feel comfortable, there are positive things happening,” said Sherri Lawson Clark, a cultural anthropologist at Wake Forest who studies housing instability among poor families. “If you get to a place where you can build that, it will create that generational stability.”

[ad_2]